Now investors can view their Total Earnings all in one place—tracking not only Monthly Dividends but also Trading Market Profits when shares are sold (that’s the appreciation, realized!)*, plus the exciting Cash Bonuses. In addition, The Dividend Day Bonus is back, but only for a limited 3-day window.

Investment Spotlight

SoCal-S18 has achieved an impressive 4.76% annualized return in its first month of operation of October. Our tenants have settled comfortably into their new home and are committed to caring for this beautiful property through March 2026, ensuring reliable rental income.

*Check out Dividend Day Bonus details in the Ark7 App, and reach out to support@ark7.com if any questions. The Dividend Day Bonus is available while shares of the Investment Spotlight property remain in supply. Terms and Conditions apply.

Ark7 Portfolio at a Glance

We distributed a total of $70,816.77 in dividends to investors from our October rental operations, reflecting a 4.28% annualized return rate*. While maintaining a healthy occupancy rate of 84.62% across the portfolio, dividends were slightly lower this month due to the off-peak season for Berkeley-M3 Airbnb, as well as the recent renovations completed at Dallas-S7 and Chandler-S4.

Refer to your Distribution Report for dividends and the return rate calculated based on your purchase price. Your share price may or may not equal the IPO price if purchased from the Trading Market.

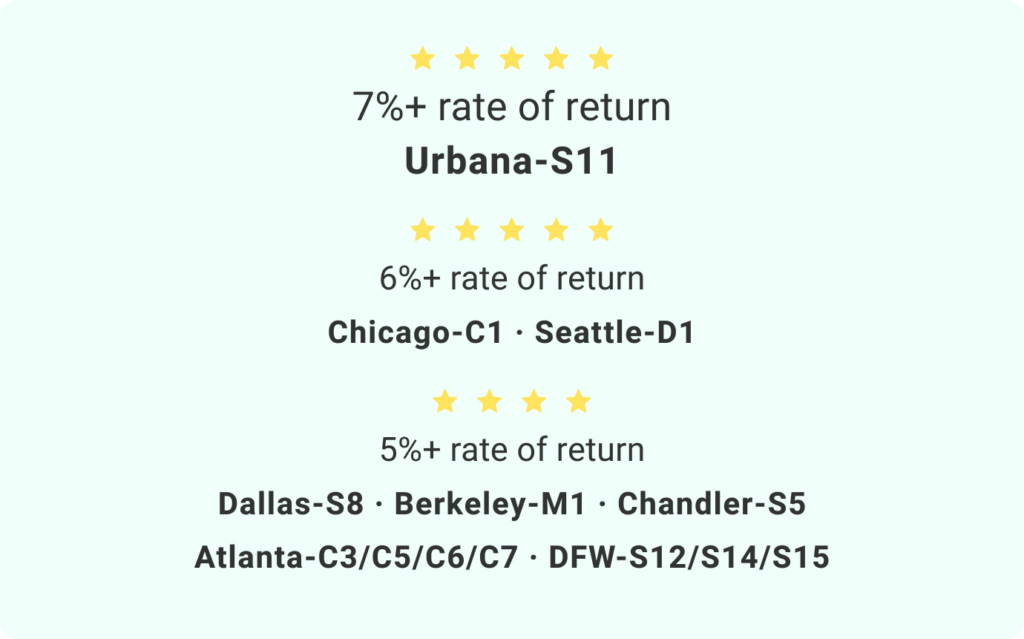

A special shoutout to the Dividend stars:

Rental Status Updates

Berkeley-M2 🏡 The renovation of one vacant unit in this six-unit multi-family property is approaching its final stage and is expected to be back on the market by mid-November. The anticipated rent for this unit will be significantly increased to the market rate of around $2,000+, improving cash returns with all 6 units occupied at the market rate. 📈 Berkeley-M2 is listed on the Trading Market.

Dallas-S7 🏡 The upgrade was completed on time, and the unit has been relisted with a targeted rent increase of 6-10% for the new lease. 📈 Dallas-S7 remains a popular listing on the Trading Market, showing a 20% gain over the IPO price (last trade) and experiencing high trading volume.

Chandler-S4 🏡 This single-family home was listed on the market the week of October 20, 2024. The team completed essential repairs to ensure the property looks its best for prospective tenants and is optimistic about securing a solid lease at the current rent, even during the slower holiday season. 🌟S4 has been under Ark7 operation for three years with a historical dividend return of 4.61%.

Berkeley-M1🏡 One unit in this five-unit multi-family will be vacant on November 15, 2024. As the tenant prepares to move out, the team is actively getting the unit ready for market listing. Another unit has just been renewed for 18 months at the same rent. The team anticipates that Berkeley-M1 will be back to full occupancy before year-end. 📈Berkeley-M1 is listed on the Trading Market.

New to passive real estate investing?

Explore Ark7 OpportunitiesTrading Market Launches

DFW-S13 is fresh on the Trading Market. 🌟 Its cash flow is healthy and steady with 8 months remaining on the annual lease. We expect DFW-S13 to continue to perform while portfolio expansion is underway into the Dallas-Fort Worth Metroplex.

Atlanta-C7 is fresh on the Trading Market, too. 🌟 With a consistent dividend return above 5%, we anticipate robust trading activity among investors for this short-term rental unit.

More trading insights to come.

* Trading Market Profits are subject to market conditions and may result in gains, losses, or sales at the purchase price.

* Portfolio annualized return rate is based on the IPO market capitalization of the property. The IPO market cap is calculated as [the IPO share price] multiplied by [the number of shares] offered during the Open Offering.