Ark7 distributed a total of $80,061.80 in dividends to investors this dividend day, reflecting an annualized return rate of 4.59% for the operating month of January 2025.

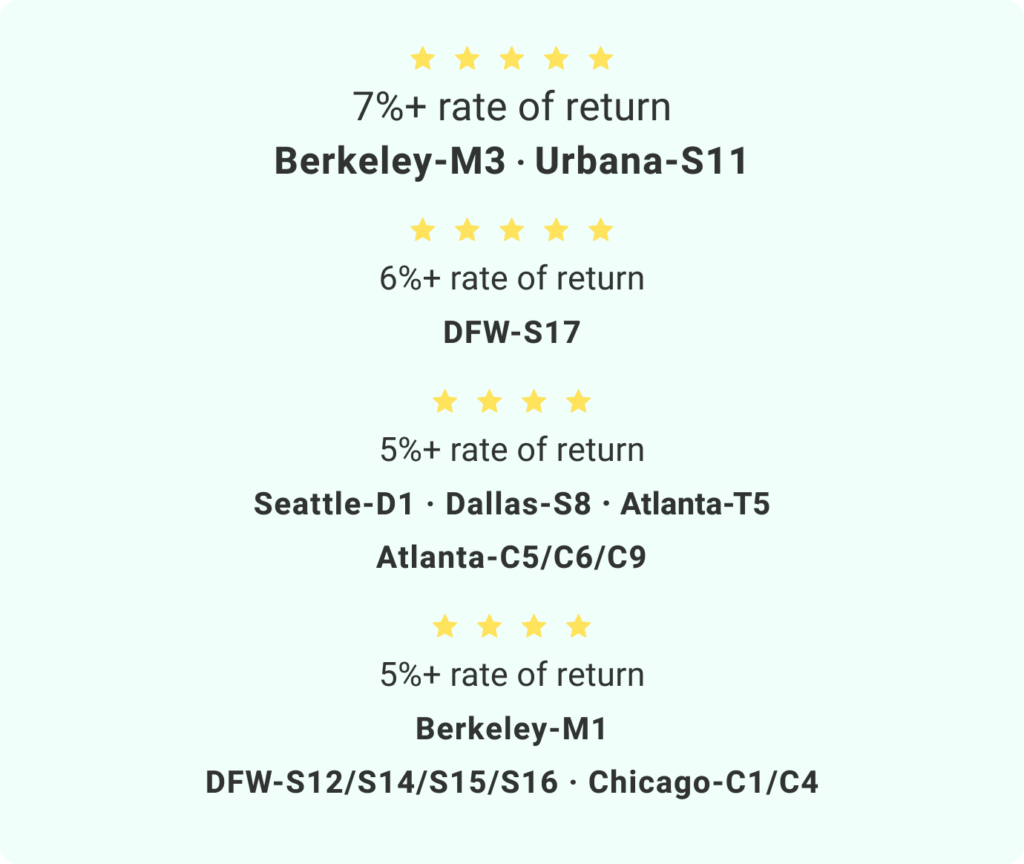

A special shoutout to the Dividend stars:

Rental Status Updates

Portfolio occupancy remains near 90% this month. The property management team is actively working on a few new tenant turnovers, including Chandler-S5 and one unit at Berkeley-M2. Other than that, we are pleased to see an exceptionally strong month for our Airbnb operation in Berkeley, CA, and stable occupancy at our Atlanta locations.

Lease Renewals

Berkeley-M1 🏡 Unit A renovations have been completed on time, and a new 12-month lease with a 3% rent increase has been signed. This multi-family unit is now fully occupied. 📈 Berkeley-M1 is listed on the Trading Market, with a 5.56% annualized historical dividend rate.

Preparing for New Tenants Moving In

Berkeley-M2 🏡 Apt1 (of 6 total units) became vacant in January and is currently listed for rent. The other 5 units remain occupied. 📈Berkeley-M2 is now trading on the Trading Market.

Dallas-S7 🏡 The property has been relisted with a target rent increase of 6-10% for the new lease. The team is actively reviewing tenant applications and aims to finalize a new lease contract by February.📈 Dallas-S7 remains a popular listing on the Trading Market.

New to passive real estate investing?

Explore Ark7 OpportunitiesTrading Market Launches

Ark7 has expanded to over 26 real estate assets (70% of all offerings) listed on the Trading Market, with more than 100 average daily trades. In 2024, the trading market saw 400% year-over-year transaction growth, reaching $1.8 million in total transactions.

As a pioneer in automated real estate investing, we are transforming the investment landscape, making real estate more accessible and efficient for everyday investors.

* Portfolio annualized return rate is based on the IPO market capitalization of the property. The IPO market cap is calculated as [the IPO share price] multiplied by [the number of shares] offered during the Open Offering.