We’re celebrating the season of gratitude with special bonuses! Take advantage of the limited-time offer to recharge your portfolio and grow your investments. It’s our way of saying thank you for being part of the journey.

New to passive real estate investing?

Explore Ark7 Opportunities*Check out your exclusive Bonus details in the Ark7 App, and reach out to support@ark7.com if any questions. The Bonus is available while Open Offering shares are in supply. Terms and Conditions apply.

Ark7 Portfolio at a Glance

November Ark7 distributed a total of $75,670.11 in dividends to investors, reflecting a 4.51% annualized return rate*. Refer to your Distribution Report for dividends and the return rate calculated based on your purchase price. Your share price may or may not equal the IPO price if purchased from the Trading Market.

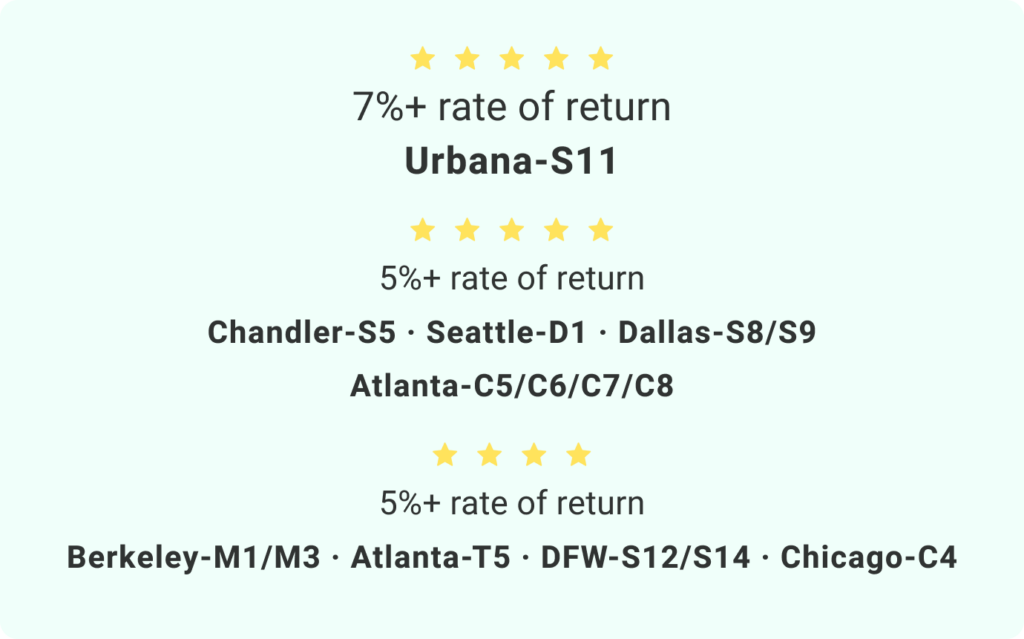

A special shoutout to the Dividend stars:

Rental Status Updates

The portfolio occupancy is at 87.12% this month, reaching a year-high. We expect the occupancy rate to improve further as we close out 2024 with new tenants moving into the last few vacant units: Berkley-M1 (1 unit), Berkeley-M2 (1 unit), and Dallas-S7. Meanwhile, the operations team reports a competitive market challenge in backfilling 1 unit of Philadelphia-D2 in November but will explore an alternative tenant strategy in December.

Four Renewals

Chandler-S4 🏡 A new lease was quickly secured after its renovation, even during the slower holiday rental season. Now at $2,600 per month— a very competitive market rent— for 12 months starting November 8th, S4 shareholders can enjoy another year of stable passive income. 🌟 S4 has been under Ark7’s operation for three years, with a historical dividend return of 4.4%.

Atlanta-T3 🏡 lease is renewed for another 18 months until mid-July 2025 at $1600 per month, providing solid passive income for its shareholders. 🌟This comes alongside a dividend return of 4.22% for the past 12 months. 📈Atlanta-T3 is active on the Trading Market. Zillow reports a historical 16% annual home value appreciation since 2016.

Chicago-C4 🏡 welcomes 2 new contracts, extending occupancy to mid-August 2025, with a rent increase from $2,300 to $2,400. 🌟 This mid-term rental unit in the heart of downtown Chicago is popular for its unbeatable location and designer vibe. It is currently generating a 4.69% annualized dividend return since operations began this June.

Chicago-C1 🏡 current tenant moved out on November 16, and the new tenant will move in on November 30 with a mid-term lease through the end of February 2025 at $2,250 per month. Shareholders experienced a lower dividend this month due to the half-month vacancy but can expect an overall healthy return, historically averaging 5.85% annualized.

Two Newly Relisted

Berkeley-M2 🏡 renovation is now completed and the unit is relisted for renting. The anticipated rent for this unit will be significantly increased to the market rate of around $2,000+, improving cash returns with all 6 units occupied at the market rate. 📈 Berkeley-M2 is active in the Trading Market.

Dallas-S7 🏡 has been relisted with a targeted rent increase of 6-10% for the new lease. We hope to bring in new tenants in December. 📈 Dallas-S7 remains a popular listing on the Trading Market.

Under renovation

Berkeley-M1 🏡 Unit A is currently undergoing renovation and is expected to be completed by mid-December. The team is also finalizing new tenant contract, with a 3% rent increase compared to the previous lease. This multi-family is anticipated to have full occupancy before year-end. 📈 Berkeley-M1 is listed on the Trading Market, with a 5.45% annualized historical dividend rate.

New to passive real estate investing?

Explore Ark7 OpportunitiesTrading Market Launches

DFW-S14 is now listed on the Trading Market. 🏡 Investors have enjoyed a 5.5% historical return since Ark7 acquired the property and took over its rental operation in August. 🌟 Now under a 12-month lease starting in June 2024 and historically stable, we expect DFW-S14 to continue delivering strong returns as portfolio expansion into the Dallas-Fort Worth Metroplex progresses.

More trading insights to come.

* Portfolio annualized return rate is based on the IPO market capitalization of the property. The IPO market cap is calculated as [the IPO share price] multiplied by [the number of shares] offered during the Open Offering.