Overview

April marked a highly positive month for Ark7’s portfolio, with $75,330.63 in total dividends distributed and a 4.21% annualized dividend return rate. Urbana-S11, DFW-S16, and Dallas-S8 led the way as top performers in dividend yield, showcasing the strength of our assets and the continued value they bring to investors.

The portfolio occupancy rate remained solid at 89.19%, bolstered by 8 new leases signed across Berkeley, Austin, Chicago, Urbana, and DFW. This strong leasing activity, combined with renewed leases in high-demand properties, positions us for a significant improvement in the vacancy rate going into May. We also continue to see stable performance from our short-term rental properties, including Berkeley-M3, Atlanta-C5, and Atlanta-C7, all yielding 5% or more.

On the trading side, $139,663 in transactions were processed, with 26 properties—70% of the portfolio—actively trading. Although trading volume saw a slight dip of -5.2% from last month, investor interest remained high in properties like Berkeley-M3, Dallas-S8, and Dallas-S7, all of which led in volume and price performance.

With key lease renewals secured, notable property upgrades completed, and consistent rental yields, Ark7 is well-positioned to continue delivering strong cash flow and liquidity for our investors. As we look ahead to May, we are confident that the vacancy rate will improve further, ensuring continued stability and growth.

1. Dividend Summary

💰 Total Dividends Distributed: $ 75,330.63

📈 Portfolio Annualized Dividend Return Rate: 4.21%

🏆 Top Performing Properties by Dividend Yield:

- Urbana-S11 – 7.65%

- DFW-S16 – 6.66%

- Dallas-S8 – 6.55%

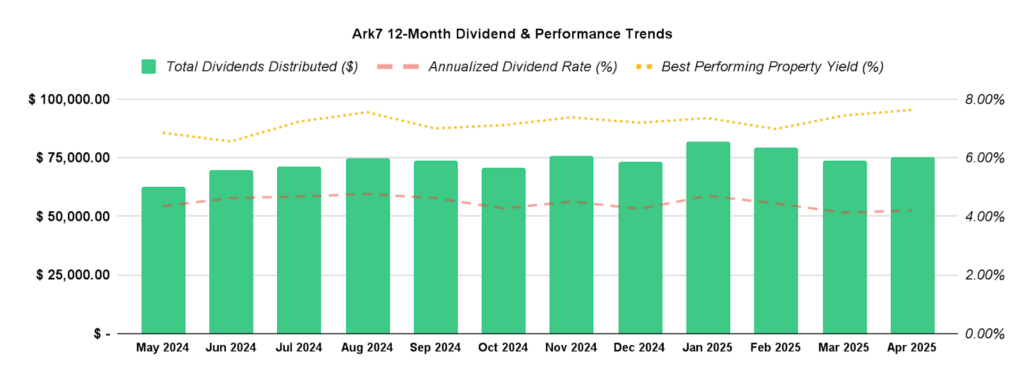

2. Dividend & Performance Trends (Past 12 Months) 📊

3. Portfolio Performance & Rental Updates

Overall Portfolio Snapshot

- Occupancy Rate: 89.19%

- New Leases Signed: 8 (Berkeley, Austin, Chicago, Urbana, DFW)

- Short-Term Rental Highlights: Berkeley-M3 (5.81%), Atlanta-C5 (5.32%) Atlanta-C7 (5.30%)

Key Rental & Lease Updates

🔹 New Lease Renewals 🏡

- Berkeley-M1 (Apt B): Renewed for 12 months at the same rent, maintaining stability and strong tenant retention.

- Berkeley-M1 (Apt E): Remodeled and rented for 12 months at $2,450/month, ensuring steady growth and value.

- Austin-S2: Renewed for 12 months at $2,425/month, locking in consistent rental income.

- Chicago-C1: Just rented for 3 months at $2,250/month, with plans to renew for a longer term, ensuring continued occupancy and income.

- Urbana-S11: Renewed for 12 months at the same rent, securing reliable income for the next year.

- Alexandria-C2: Extended for 1 more month, from 05/15/2025 to 06/15/2025, at the same rent, ensuring continued occupancy with minimal disruption.

- DFW-S15: Signed a 24 months lease at $1,850/month, starting 05/01/2025, guaranteeing long-term value and stability.

- DFW-S17: Signed a 12 months lease at $1,500/month, starting 05/01/2025, locking in stable income for the next year.

🔹 Vacancy & Tenant Turnovers

No new vacancies or tenant turnovers this month, maintaining stable occupancy across our portfolio!

🔹 Operational Events

- DFW-S14: Vacant since early January 2025. Working with the insurance company for a remodel, ensuring the property is ready for the next tenant.

🔹 Notable Short-Term Rental Performance

The short-term rental segment continues demonstrating strong performance, exceeding a 5%+ rental yield.

| Property | Dividend |

|---|---|

| Berkeley-M3 | 5.81% |

| Atlanta-C5 | 5.32% |

| Atlanta-C7 | 5.30% |

4. Featured Investment Opportunities 🚀

New to passive real estate investing?

Explore Ark7 Opportunities5. Trading Market Growth 📊

- Total Transactions This Month: $ $139,663

- Month-over-Month Growth: –5.2%

- Properties Available for Trading: 26 (70% of portfolio)

Top 3 Properties by Trading Volume:

The following properties saw the highest trading activity this month, reflecting strong investor interest and market liquidity.

| Property | Trading Volume | Price Change | Trading Volume Growth |

|---|---|---|---|

| Berkeley-M3 | $20,636 | -2.11% | -32.44% |

| Dallas-S8 | $12,815 | +7.50% | +14.16% |

| Dallas-S7 | $10,838 | +2.25% | +151.23% |

Top 3 Properties by Performing (Price Change):

These properties experienced the highest price appreciation, demonstrating strong growth potential and investor confidence.

| Property | Price Change |

|---|---|

| Urbana-S11 | +18.00% |

| Atlanta-T3 | +11.75% |

| Chicago-C1 | +10.00% |