Overview

August continues to be a month of stable returns for Ark7’s portfolio, with $81,432.14 in total dividends distributed and a 4.36% annualized dividend return rate. DFW-S19, Urbana-S11, and Atlanta-T3 led in dividend yield, delivering returns of 6.89%, 6.88%, and 6.30%. This shows the cash-yielding strength of our top-performing assets.

The portfolio’s occupancy rate remained steady at 90.79%, reflecting consistent performance across our properties. Several units that were undergoing maintenance and upgrades are nearing completion, with some already listed for rent and others to be listed shortly. Two units in Berkeley M1 and Tampa S10 became available this month and are being prepared for the market. With activity gradually picking up following the back-to-school period, we anticipate increased leasing interest as these refreshed units come online.

Short-term rental properties continued to perform well, with Berkeley-M3 (5.40%), Seattle-D1 (5.00%), and Atlanta-C6 (4.22%) all yielding over 4%.

On the trading side, $89,749 in transactions were processed, with 26 properties (70% of the portfolio) actively trading. Dallas-S9, Chicago-C4, and Dallas-S8 topped the charts in trading volume and investor activity, while Urbana-S11 led all properties with a 39.5% price increase, followed by Dallas-S8 and Atlanta-T3.

With stable rental performance and more properties already relisted for rent, Ark7 continues to offer reliable returns and steady growth to our investors.

1. Dividend Summary

💰 Total Dividends Distributed: $81,432.14

📈 Portfolio Annualized Dividend Return Rate: 4.36%

🏆 Top Performing Properties by Dividend Yield:

- DFW-S19 – 6.89%

- Urbana-S11 – 6.88%

- Atlanta-T3 – 6.30%

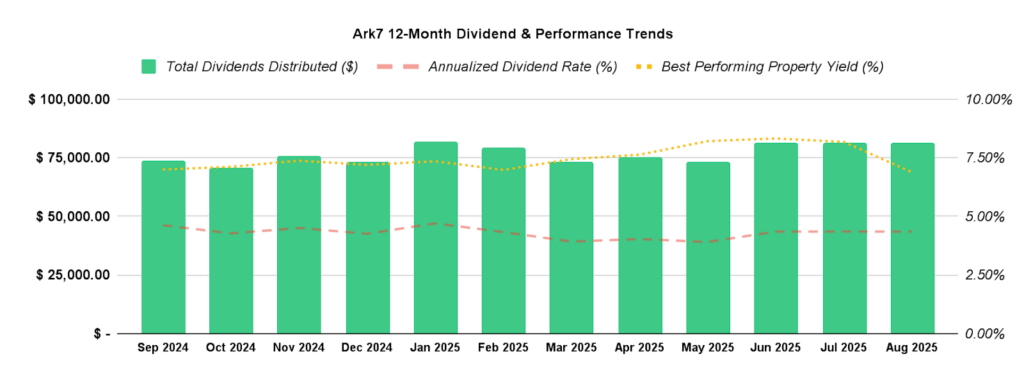

2. Dividend & Performance Trends (Past 12 Months) 📊

3. Portfolio Performance & Rental Updates

Overall Portfolio Snapshot

- Occupancy Rate: 90.79%

- New Leases Signed: 0

- Short-Term Rental Highlights: Berkeley-M3 (5.40%), Seattle-D1 (5.00%), Atlanta-C6 (4.22%)

Key Rental & Lease Updates

🔹 Vacancy & Tenant Turnovers

2 new vacancies this month for Berkeley-M1 and Tampa-S10 due to lease termination. We have already listed both properties for rent.

🔹 Operational Events

🔹 Notable Short-Term Rental Performance

The short-term rental segment continues demonstrating strong performance, exceeding a 4%+ rental yield.

| Property | Dividend |

|---|---|

| Berkeley-M3 | 5.40% |

| Seattle-D1 | 5.00% |

| Atlanta-C6 | 4.22% |

4. Featured Investment Opportunities 🚀

New to passive real estate investing?

Explore Ark7 Opportunities5. Trading Market Growth 📊

- Total Transactions This Month: $89,749

- Month-over-Month Growth: -30.52%

- Properties Available for Trading: 26 (70% of portfolio)

Top 3 Properties by Trading Volume:

The following properties saw the highest trading activity this month, reflecting strong investor interest and market liquidity.

| Property | Trading Volume | Price Change | Trading Volume Growth |

|---|---|---|---|

| Arizona City-S6 | $11,747 | 5.00% | +12.24% |

| Chicago-C4 | $10,262 | 0.00% | +207.52% |

| Dallas-S8 | $8,374 | 17.50% | -19.44% |

Top 3 Properties by Performing (Price Change):

These properties experienced the highest price appreciation, demonstrating strong growth potential and investor confidence.

| Property | Price Change |

|---|---|

| Urbana-S11 | +39.50% |

| Dallas-S8 | +17.50% |

| Atlanta-T3 | +10.00% |