Overview

March marked a steady month across Ark7’s portfolio, with $73,986.02 in total dividends distributed and a 4.13% annualized dividend return rate. Urbana-S11, DFW-S16, and Dallas-S8 led the way as top performers in dividend yield.

The overall portfolio occupancy rate remained strong at 90.54%, supported by successful new leases in Berkeley, Seattle, and Dallas, along with stable short-term rental income, all delivering over 5% yield.

On the trading front, $147,452 in transactions were processed, with 26 properties—70% of the portfolio — actively trading. While overall trading volume saw a slight dip from last month, investor interest remained high in properties like Berkeley-M3, Berkeley-M1, and Dallas-S8, all of which led in volume and price performance.

With key lease renewals secured, notable upgrades completed, and consistent rental yields, Ark7 continues to deliver solid cash flow and liquidity for investors.

1. Dividend Summary

💰 Total Dividends Distributed: $ 73,986.02

📈 Portfolio Annualized Dividend Return Rate: 4.13%

🏆 Top Performing Properties by Dividend Yield:

- Urbana-S11 – 7.45%

- DFW-S16 – 6.62%

- Dallas-S8 – 6.45%

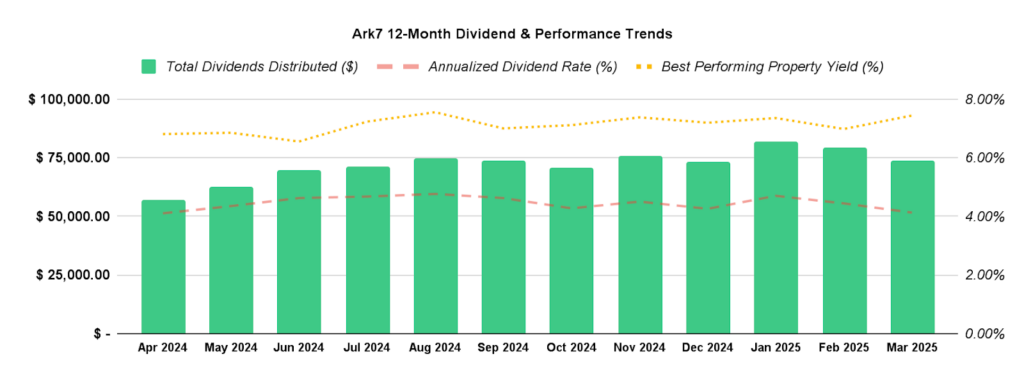

2. Dividend & Performance Trends (Past 12 Months) 📊

3. Portfolio Performance & Rental Updates

Overall Portfolio Snapshot

- Occupancy Rate: 90.54%

- New Leases Signed: 3 (Berkeley, Seattle, Dallas)

- Short-Term Rental Highlights: Atlanta-C6 (5.49%), Atlanta-C10 (5.39%), Berkeley-M3 (5.17%)

Key Rental & Lease Updates

🔹 New Lease Renewals 🏡

- Berkeley-M2 (Apt 1): Successfully renewed with a 12-month lease from 03/01/2025 to 03/01/2026 at $2,400/month, reflecting a 9.09% rent increase (previously $2,200). All six units remain fully occupied, ensuring stable income.

- DFW-S16: New 12-month lease signed through 04/01/2026 at $1,500/month, securing consistent rental income.

- Seattle-D1 – 5248: A solid 18-month lease signed through 04/01/2027 at $1,250/month, locking in long-term value.

🔹 Vacancy & Tenant Turnovers

- Berkeley-M1 (Apt E): Newly remodeled in just one month and now listed on the market, ready to attract new tenants.

- Chicago-C1: Tenant moved out and is currently listed for rent.

- DFW-S17: Lease ended, unit repaired and now listed for rent.

🔹 Operational Events

- Tampa-S10: Repairs for wall collapse, mold, and leakage completed at $11,704. Tenant received a $600 rent credit and is satisfied, willing to extend the lease.

- Memphis-M4: Two units affected by a blaze; we are actively working with tenants and insurance on resolution.

🔹 Notable Short-Term Rental Performance

The short-term rental segment continues to demonstrate strong performance, exceeding a 5%+ rental yield.

| Property | Dividend |

|---|---|

| Atlanta-C6 | 5.49% |

| Berkeley-M3 | 5.17% |

| Seattle-D1 | 5.18% |

4. Featured Investment Opportunities 🚀

New to passive real estate investing?

Explore Ark7 Opportunities5. Trading Market Growth 📊

- Total Transactions This Month: $ 147,452

- Month-over-Month Growth: –8.3%

- Properties Available for Trading: 26 (70% of portfolio)

Top 3 Properties by Trading Volume:

The following properties saw the highest trading activity this month, reflecting strong investor interest and market liquidity.

| Property | Trading Volume | Price Change | Trading Volume Growth |

|---|---|---|---|

| Berkeley-M3 | $30,544 | -1.75% | -9.60% |

| Berkeley-M1 | $21,620 | 0% | +475.61% |

| Dallas-S8 | $11,182 | +7% | +83.68% |

Top 3 Properties by Performing (Price Change):

These properties experienced the highest price appreciation, demonstrating strong growth potential and investor confidence.

| Property | Price Change |

|---|---|

| Chicago-C1 | +20% |

| Urbana-S11 | +15% |

| Dallas-S9 | +7.5% |