Overview

May was another strong month for Ark7’s portfolio, with $ 79,979.97 in total dividends distributed and a 4.42% annualized dividend return rate. Urbana-S11, Dallas-S8, and Dallas-S7 led in dividend yield, delivering returns of 8.22%, 7.04%, and 6.33%. This underscores the ongoing strength of our top-performing assets.

The portfolio’s occupancy rate held steady at a robust 93.24%, supported by 4 new leases signed across Austin, Philadelphia, and Chicago. Strategic lease renewals, including long-term agreements in Austin-S1 and Philadelphia-D2, contributed to overall portfolio stability. Notably, there were no new vacancies or tenant turnovers in May, signaling consistent tenant retention.

Short-term rental properties continued to perform well, with Seattle-D1 (6.10%), Atlanta-C6 (5.39%), and Atlanta-C5 (5.16%) all yielding over 5%.

On the trading side, $101,617 in transactions were processed, with 26 properties (70% of the portfolio) actively trading. Berkeley-M3, Tampa-S10, and Dallas-S9 topped the charts in trading volume and investor activity, while Urbana-S11 led all properties with a 35% price increase, followed by Chicago-C1 and Atlanta-T3.

With strong rental performance, no new vacancies, and key lease renewals secured, Ark7 continues to offer reliable returns and steady growth to our investors.

1. Dividend Summary

💰 Total Dividends Distributed: $ 79,979.97

📈 Portfolio Annualized Dividend Return Rate: 4.42%

🏆 Top Performing Properties by Dividend Yield:

- Urbana-S11 – 8.22%

- Dallas-S8 – 7.04%

- Dallas-S7 – 6.33%

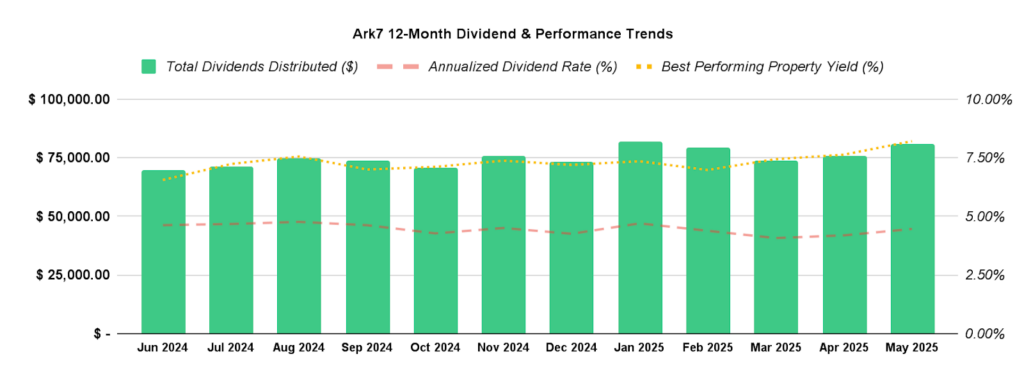

2. Dividend & Performance Trends (Past 12 Months) 📊

3. Portfolio Performance & Rental Updates

Overall Portfolio Snapshot

- Occupancy Rate: 93.24%

- New Leases Signed: 4 (Austin, Philadelphia, Chicago)

- Short-Term Rental Highlights: Seattle-D1 (6.10%), Atlanta-C6 (5.39%), Atlanta-C5 (5.16%)

Key Rental & Lease Updates

🔹 New Lease Renewals 🏡

- Austin-S1: Renewed for 12 months at the same rent, maintaining stability and strong tenant retention.

- Philadelphia-D2 (Unit B): Signed a 12 months lease at $2,000/month, starting 08/01/2025, locking in stable income for the next year.

- Chicago-C1: Extended for 3 more months, from 08/15/2025 to 10/15/2025, at the same rent, ensuring continued occupancy with minimal disruption.

- Chicago-C4: Signed a 12 months lease at $2,300/month, starting 08/18/2025, ensuring stable income for the next year.

🔹 Vacancy & Tenant Turnovers

No new vacancies or tenant turnovers this month, maintaining stable occupancy across our portfolio!

🔹 Operational Events

- Memphis-M4 (Unit 759, 761): Vacant since April 2025. Working with the insurance company for a remodel, ensuring the property is ready for the next tenant.

- DFW-S14: Vacant since early January 2025. Working with the insurance company for a remodel, ensuring the property is ready for the next tenant.

🔹 Notable Short-Term Rental Performance

The short-term rental segment continues demonstrating strong performance, exceeding a 5%+ rental yield.

| Property | Dividend |

|---|---|

| Seattle-D1 | 6.10% |

| Atlanta-C6 | 5.39% |

| Atlanta-C5 | 5.16% |

4. Featured Investment Opportunities 🚀

New to passive real estate investing?

Explore Ark7 Opportunities5. Trading Market Growth 📊

- Total Transactions This Month: $ 101,617

- Month-over-Month Growth: –27.4%

- Properties Available for Trading: 26 (70% of portfolio)

Top 3 Properties by Trading Volume:

The following properties saw the highest trading activity this month, reflecting strong investor interest and market liquidity.

| Property | Trading Volume | Price Change | Trading Volume Growth |

|---|---|---|---|

| Berkeley-M3 | $13,705 | -0.88% | -33.59% |

| Tampa-S10 | $11,861 | +1.00% | +23.28% |

| Dallas-S9 | $9,542 | +7.80% | +1.46% |

Top 3 Properties by Performing (Price Change):

These properties experienced the highest price appreciation, demonstrating strong growth potential and investor confidence.

| Property | Price Change |

|---|---|

| Urbana-S11 | +35.00% |

| Chicago-C1 | +14.00% |

| Atlanta-C3 | +12.50% |