Overview

November continues to be a month of steady returns for Ark7’s portfolio, with $75,538.20 in total dividends distributed and a 3.96% annualized dividend return rate. Urbana-S11, DFW-S19, and Dallas-S9 led in dividend yield, delivering returns of 7.65%, 6.22%, and 6.05%. This shows the cash-yielding strength of our top-performing assets.

The portfolio’s occupancy rate saw another month of increase at 94.81%, reflecting growing rental demand across our properties. We’ve secured several new leases to ensure long-term rental income, including Dallas-S8, and DFW-T7. In addition, DFW-T8 has secured a lease extension through November, 2026, which will continue to generate stable rental income.

Short-term rental properties continued to contribute steady income, with Berkeley-M3 (4.67%), Atlanta-C6 (4.40%), Atlanta-C5 (4.31%) all yielding over 4%.

On the trading side, $61,662 in transactions were processed, with 27 properties (70% of the portfolio) actively trading. Tampa-S10, Urbana-S11, and Berkeley-M3 topped the charts in trading volume and investor activity, while Urbana-S11 led all properties with a 25% price increase, followed by Dallas-S8, and Dallas-S9.

With growing rental income performance, and properties entering new long-term leases, Ark7 continues to offer reliable returns and steady growth to our investors.

1. Dividend Summary

💰 Total Dividends Distributed: $75,538.20

📈 Portfolio Annualized Dividend Return Rate: 3.96%

🏆 Top Performing Properties by Dividend Yield:

- Urbana-S11 – 7.65%

- DFW-S19 – 6.22%

- Dallas-S9 – 6.05%

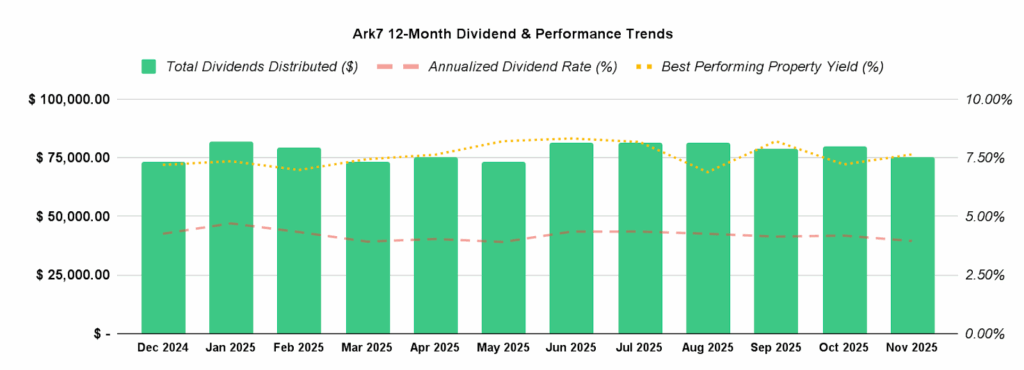

2. Dividend & Performance Trends (Past 12 Months) 📊

3. Portfolio Performance & Rental Updates

Overall Portfolio Snapshot

- Occupancy Rate: 94.81%

- New Leases Signed: 3

- Short-Term Rental Highlights: Berkeley-M3 (4.67%), Atlanta-C6 (4.40%), Atlanta-C5 (4.31%)

Key Rental & Lease Updates

🔹 New Lease Renewals 🏡

- Dallas-S8: Signed a 12-month lease at $3,031/month, starting 11/30/2025.

- DFW-T7: Signed a 12-month lease at $1,400/month, starting 11/30/2025.

- DFW-T8: Signed a 6-month lease extension at $1,500/month, starting 5/31/2026.

🔹 Vacancy & Tenant Turnovers

No new vacancies this month.

🔹 Operational Events

No new operational events this month.

🔹 Notable Short-Term Rental Performance

The short-term rental segment continues demonstrating strong performance, exceeding a 4%+ rental yield.

| Property | Dividend |

|---|---|

| Berkeley-M3 | 4.67% |

| Atlanta-C6 | 4.40% |

| Atlanta-C5 | 4.31% |

4. Featured Investment Opportunities 🚀

New to passive real estate investing?

Explore Ark7 Opportunities5. Trading Market Growth 📊

- Total Transactions This Month: $61,662

- Month-over-Month Growth: -11.22%

- Properties Available for Trading: 27 (70% of portfolio)

Top 3 Properties by Trading Volume:

The following properties saw the highest trading activity this month, reflecting strong investor interest and market liquidity.

| Property | Trading Volume | Price Change | Trading Volume Growth |

|---|---|---|---|

| Tampa-S10 | $7,928 | -10.00% | 6.37% |

| Urbana-S11 | $6,907 | 25.00% | -56.85% |

| Berkeley-M3 | $5,280 | -6.32% | 15.49% |

Top 3 Properties by Performing (Price Change):

These properties experienced the highest price appreciation, demonstrating strong growth potential and investor confidence.

| Property | Price Change |

|---|---|

| Urbana-S11 | +25.00% |

| Dallas-S8 | +10.00% |

| Dallas-S9 | +9.85% |