Our first operating month in 2024 ends on a high note. While Ark7 currently offers investment opportunities in 10 states, we are excited to announce the expansion of our short-term rental portfolio in four of those states: Georgia, California, Washington, and Illinois. With close to 100% occupancy and a competitive rent increase at renewal for our single-family long-term rentals, adding short-term and mid-term rentals provides rich options to tailor a flexible and diversified rental investment mix based on investors’ own strategies and financial goals.

Ark7 Portfolio at a Glance

Our portfolio continues to generate consistent cash returns, distributing a total dividend amount of $62,204.74 at a 4.47% annualized rate of return from rental operations.

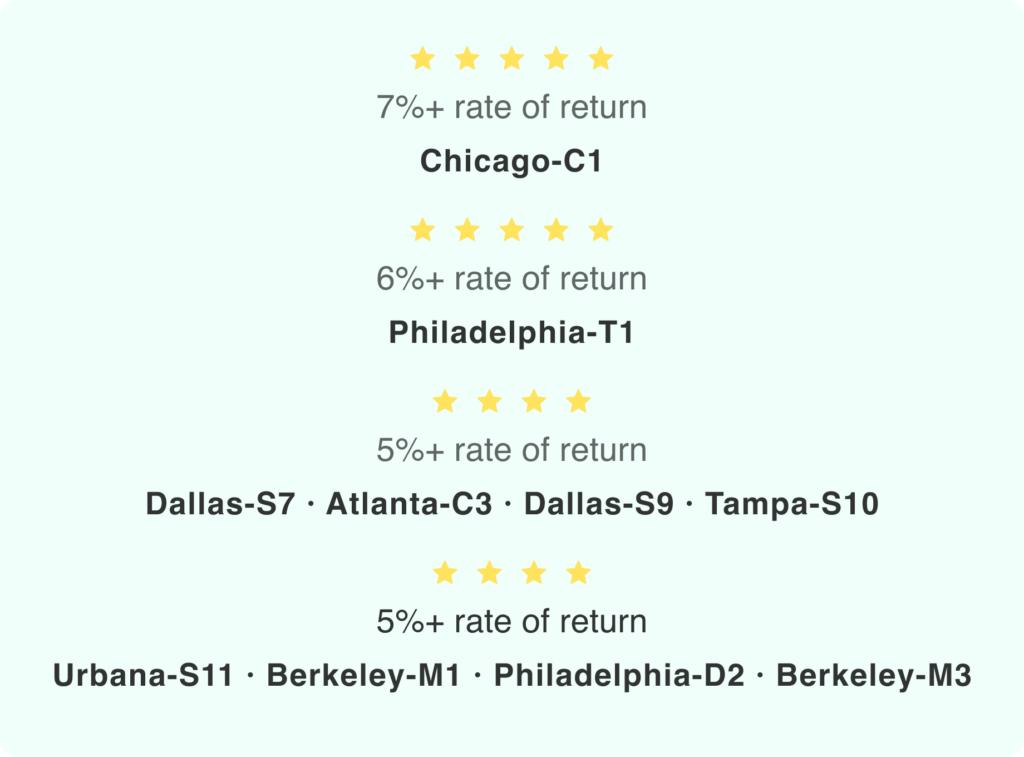

Shoutout to our star performers in January 2024:

A Sneak Peak into Airbnb Operations

Atlanta-C3 delivers a 5.12% dividend rate for its first full month of operation, showcasing the return potential of this unique site opportunity and our commitment to operational excellence. As we expand our short-term rentals in the area, our consolidated resources are strategically deployed to optimize further opportunities. C3 sold out within days, and special thanks go to the 295 investors with fractional ownership of this property.

Berkeley-M3 has consistently delivered a 5%+ dividend rate for three consecutive months and earned the title of ‘Guest Favorite’ based on highly positive reviews. Being just 1.1 miles from downtown Berkeley and 1.8 miles from the UC-Berkeley campus, the location is a key selling point for this popular guest house.

Secondary Market Launches

Atlanta-T4 is now actively trading on the secondary market, attracting highly competitive buy orders. Located in the same community as Atlanta-T3, this newly-built townhome from 2020 features 3 bedrooms, and a private backyard on the 6,817 sq ft lot. The rental income has remained stable, showcasing financial health attributed to high demand, minimal maintenance, low property taxes, and an average insurance rate.

Philadelphia-D2 is our newest listing on the secondary market. For those who didn’t get a chance to chip in your order on Philadelphia-D2 during the initial offering, now is your chance to name your own price. This star performer is a duplex student housing near Temple University and has delivered an average of 6.29% historical cash yields.

Property Highlights

Chandler-S5

A 5,000+ sq ft lot, near top employers and essential amenities. The long-term rental lease has just been renewed!

Dallas-S9

One of the most popular offerings on the secondary market. 300+ shares are available for purchase!

Berkeley-M3

UC Berkeley Airbnb with 5%+ cash returns and good appreciation potential. 800+ shares are available for purchase!