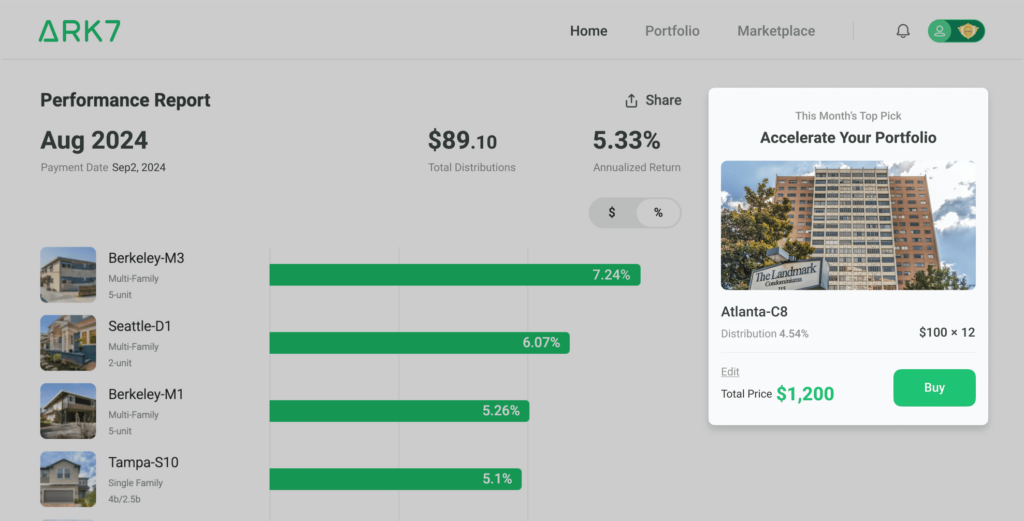

Investing in Atlanta-C8, our 5th Airbnb unit downtown with proven operational excellence, can help scale your multi-unit Airbnb assets for consistent passive income.

Now, you can snap up C8 shares directly from this month’s Performance Report (website or latest version of the Ark7 app required).

Reinvest Made Easy Buy: Directly From Your Report

Ark7 Portfolio at a Glance

Ark7 distributed $74,800.45 in dividends, a 4.77% annualized cash return. It also marked five consecutive months of growth, reaching a new portfolio high for 2024.[1]

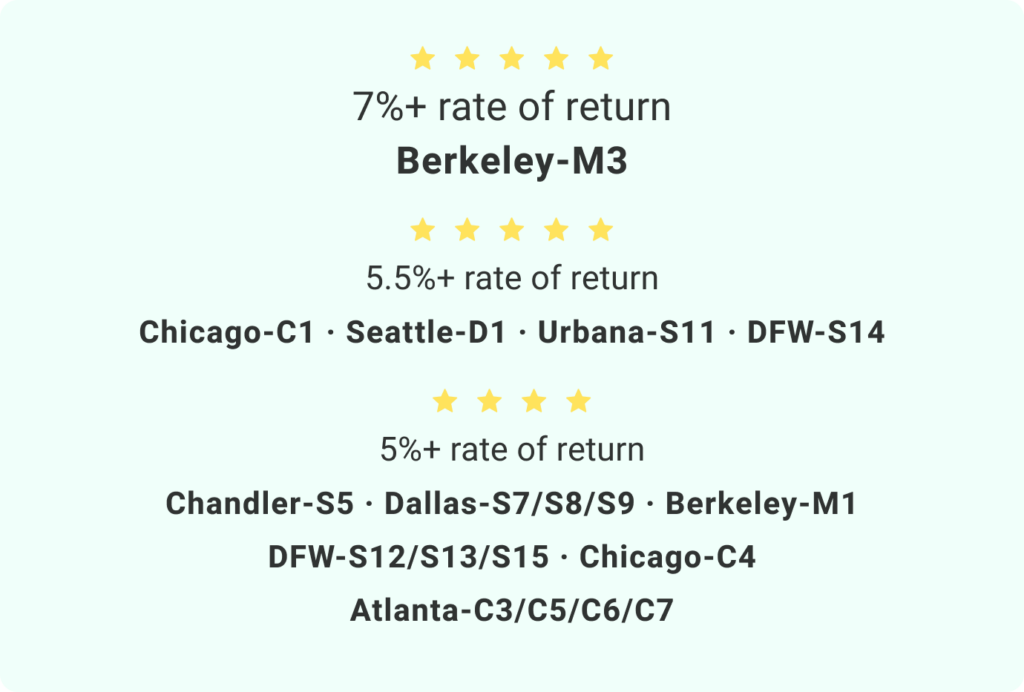

56% of our operating properties achieved 5% or higher returns in August. Berkeley Airbnb M3 led with a 7.56% return, setting another record following July’s 7.24%. Seattle-D1 also delivers a return nearing 6% with full occupancy.

[1] The return rate is based on the IPO market capitalization of the property. The IPO market cap is calculated as [the IPO share price] multiplied by [the number of shares] offered during the Open Offering.

For investors holding shares, your performance report’s annualized cash return rate is calculated based on your share purchase price, rather than the IPO price. Review the report and ask questions at support@ark7.com.

New Listing on Trading Market

Atlanta-C5 and Atlanta-C6 are now tradable. Our industry-first trading market offers the flexibility to sell shares at market price and realize potential gains beyond monthly dividends.

Lease Renewal

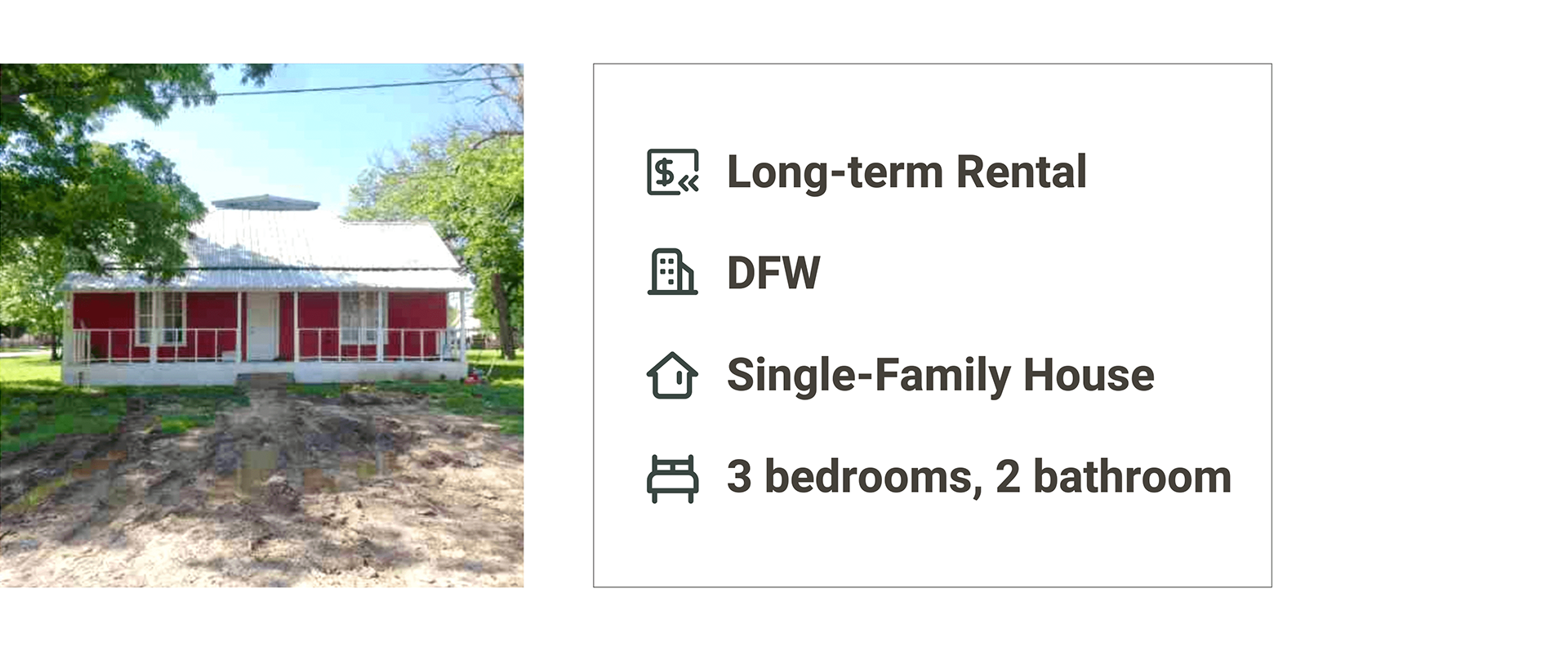

Dallas-S9 has renewed its lease until the end of September 2025, ensuring another celebrating year of passive income. 🌟 This single-family home in the Dallas-Fort Worth Metroplex has been under Ark7’s management since 2022, delivering consistent rental income close to 5% and high appreciation potential. 📈 It is now actively trading on the market, with a 15% gain from its IPO price.

Berkeley-M2 one unit has renewed its lease for another 18 months until March 2026, at $2,150 per month. Five units of this multi-family home near UC Berkeley are currently occupied, while the newly vacant 6th unit is undergoing a value-add renovation to achieve premium market rent and attract new tenants. 📈 Shares are tradable on the Trading Market.

Alexandria-C2 the mid-term rental condo welcomes its new tenants, securing passive income for another 7 months. It is set to be listed on the Trading Market after the minimum holding period from the IPO. 🌟 This inviting 1-bedroom, 1-bathroom urban oasis is just minutes away from essential amenities and offers seamless connectivity for work and exploration in Alexandria and Washington, D.C.

The portfolio occupancy rate stands at 85.94% going into September, an improvement from August’s 84%. Vacant units on the market include Dallas-S7 and one of the two units in Philadelphia-D2, both of which are actively seeking new tenants.

Upcoming Offering Preview

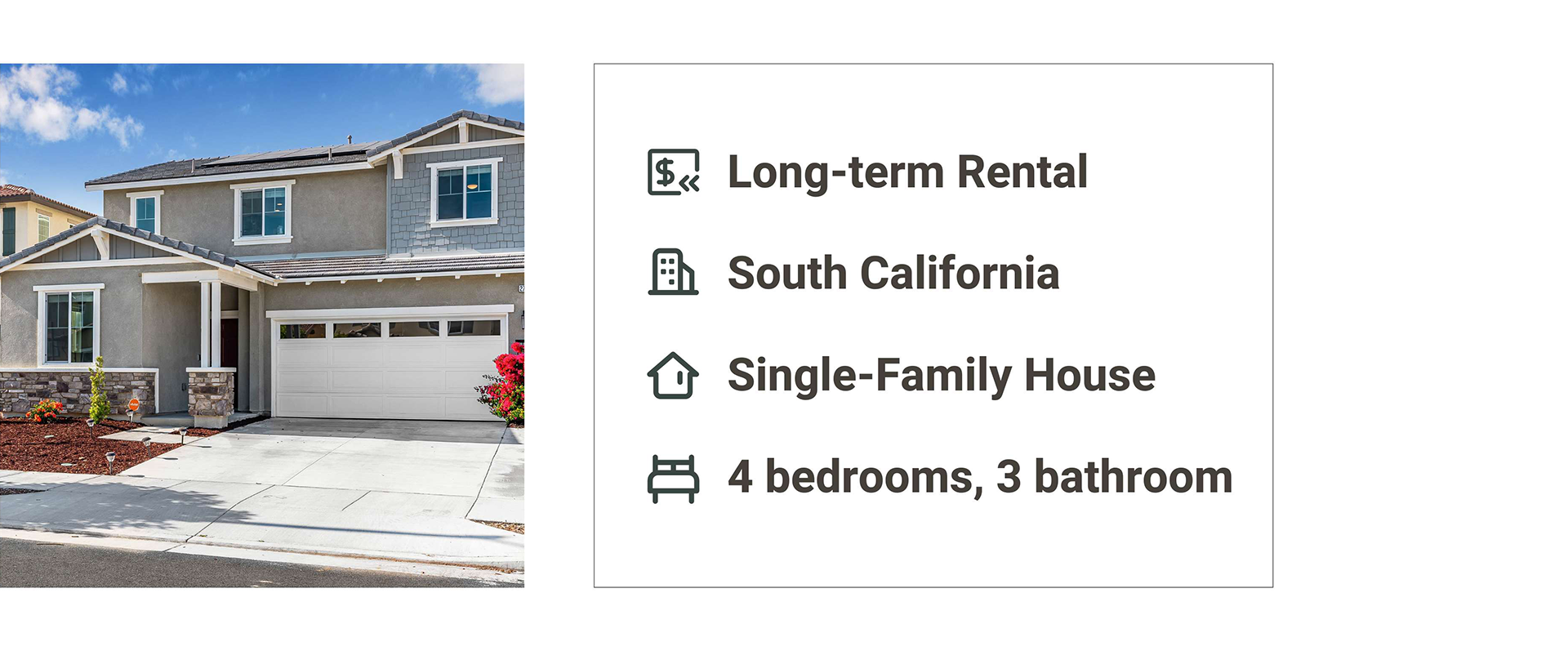

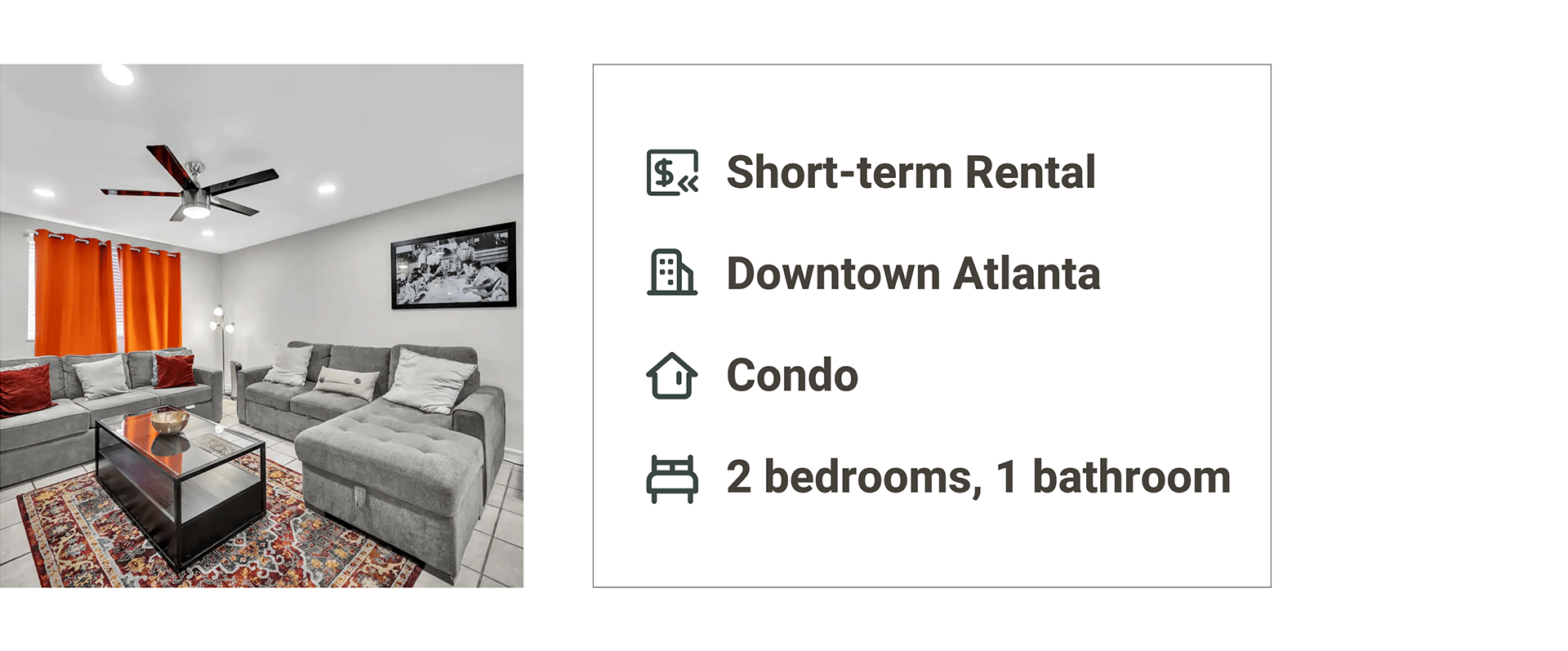

Our team is preparing a selection of carefully curated single-family homes and condos in the popular Sunbelt region, featuring both long-term rentals and short-term Airbnb options.

As we wrap up Atlanta-C8 with its final shares remaining during the IPO, look forward to our next offering in the much-anticipated Southern California market, which promises substantial equity growth opportunities. Stay tuned for more details coming soon!