Raw material prices skyrocket, causing real estate prices to increase

- The price of lumber jumped about 320% since last year.

- Copper increased by about 96% since last year while steel increased by around 198% in the past year.

- Real estate prices have surged 12% every year, and low supply of new housing adds to the increase.

- New startups like Ark7 found ways to help investors capitalize on the high demand of housing.

In order to create a property, the structure and frame must be built. 90% of new homes built in the past three years have been wood-framed. The price of lumber jumped about 320% since last year. Without the bones of the operation, the home is out-of-commission, unless you have more money to import it. This is causing real estate prices to increase.

Lumber supply is down due to pandemic closures and natural causes

Last week, Wells Fargo released an analytical study of the sharp increase in cost of lumber. They found that a variety of reasons led to this increase with the first being an error in the basic principle of supply and demand.

The COVID-19 pandemic suspended, hindered and shut down many sawmills that provide for housing projects. This shutdown caused many parts of the industry to struggle, including rehiring workers and dealing with higher gas prices for wood transportation. Other natural forces like wildfires in the Northwest have been a cause for wood shortages and slow sawmill production. Canada has its own battles, as it deals with beetle infestation that ruined about 15 years worth of lumber supplies. Canada is the United States’ largest importer of lumber, as it accounts for 83% of all softwood imports totaling around $4.5 billion. The U.S. is having to turn to European exports, which are much more expensive than Canadian exports.

Effects on Real Estate

All of these inhibitions created a drastic gap between the amount of lumber available and the steady rate of home construction. This creates a historic surge in wood pricing at around $1,645 per thousand board feet, when only one year ago in 2020 the price was $346 per thousand board feet. In addition to lumber, copper and steel have seen upticks in price. Copper increased by about 96% since last year while steel increased by around 198% in the past year.

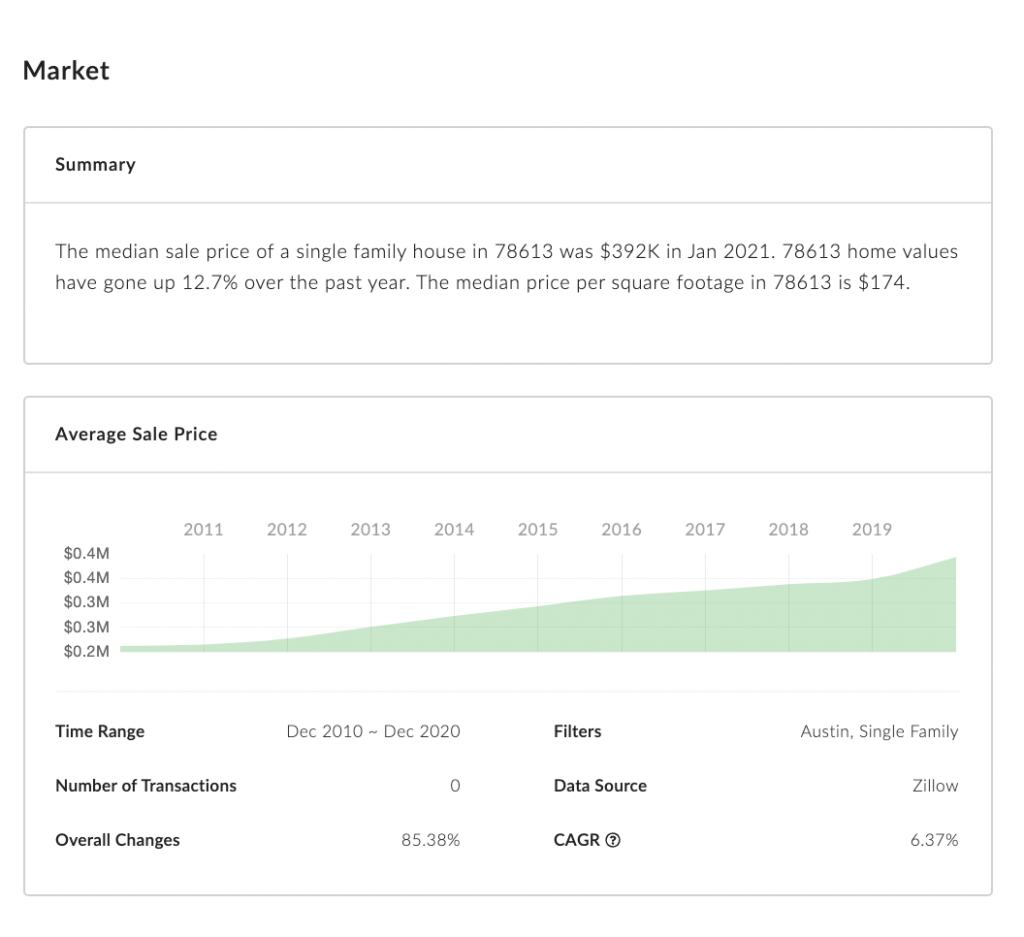

According to Investopedia, the number one indicator of the real estate market is construction spending. All of these increases in price have also elongated the time it takes to receive the item, and overall, finish a new housing project. This is why many have turned to purchasing pre-built homes. Real estate prices have surged 12% every year, and low supply of new housing adds to the increase.

Many are seeing effects on pre-built homes as well. According to Mark Labourdette, owner of a California home building company, a kitchen remodel costs about twice as much as it used to. These issues have the possibility to spill over onto investors. Repairs and other issues that fall onto property managers could mean trouble for real estate investors, especially remote ones.

New and Innovative Solutions to Combat Material Shortages

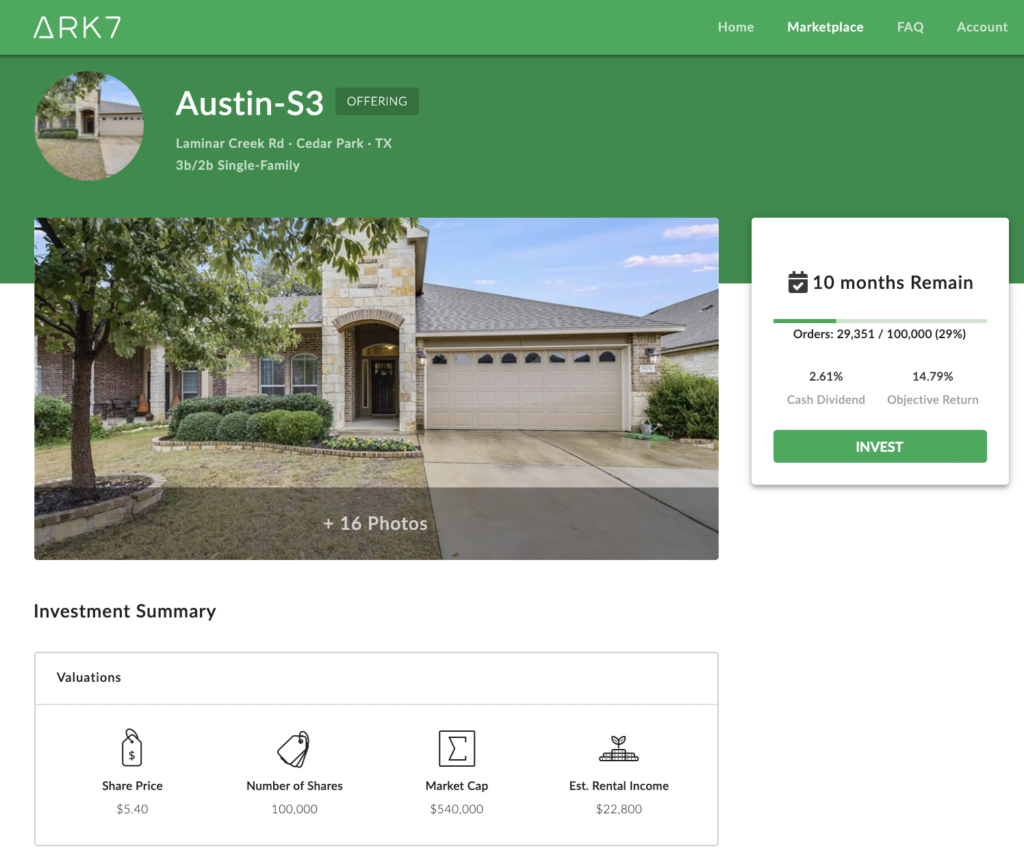

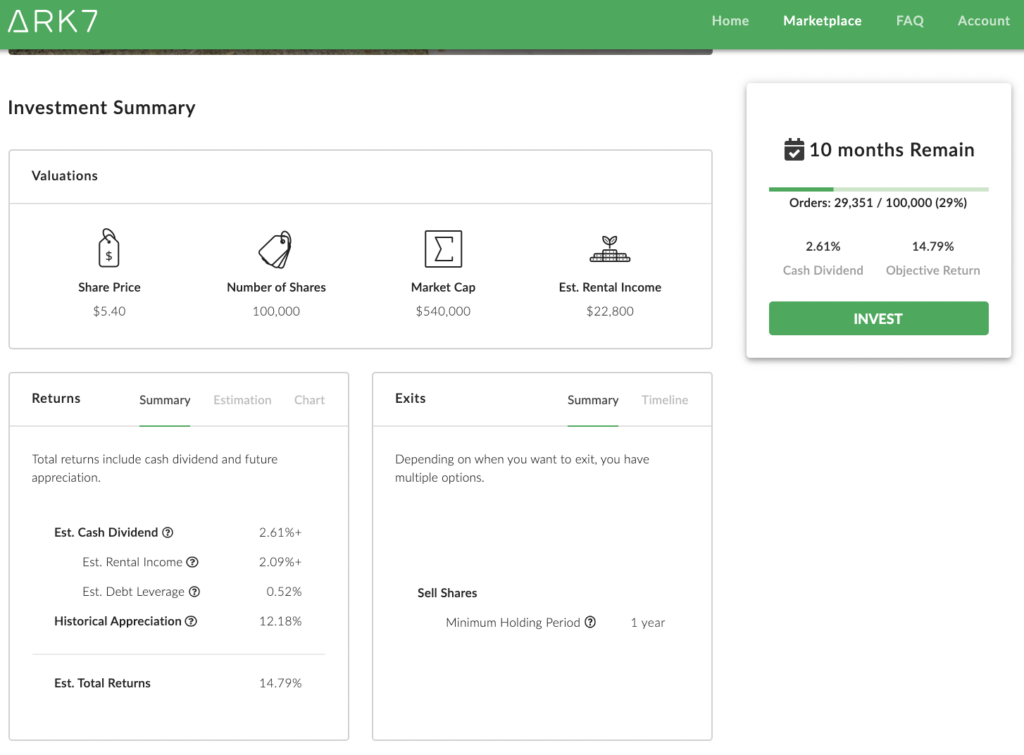

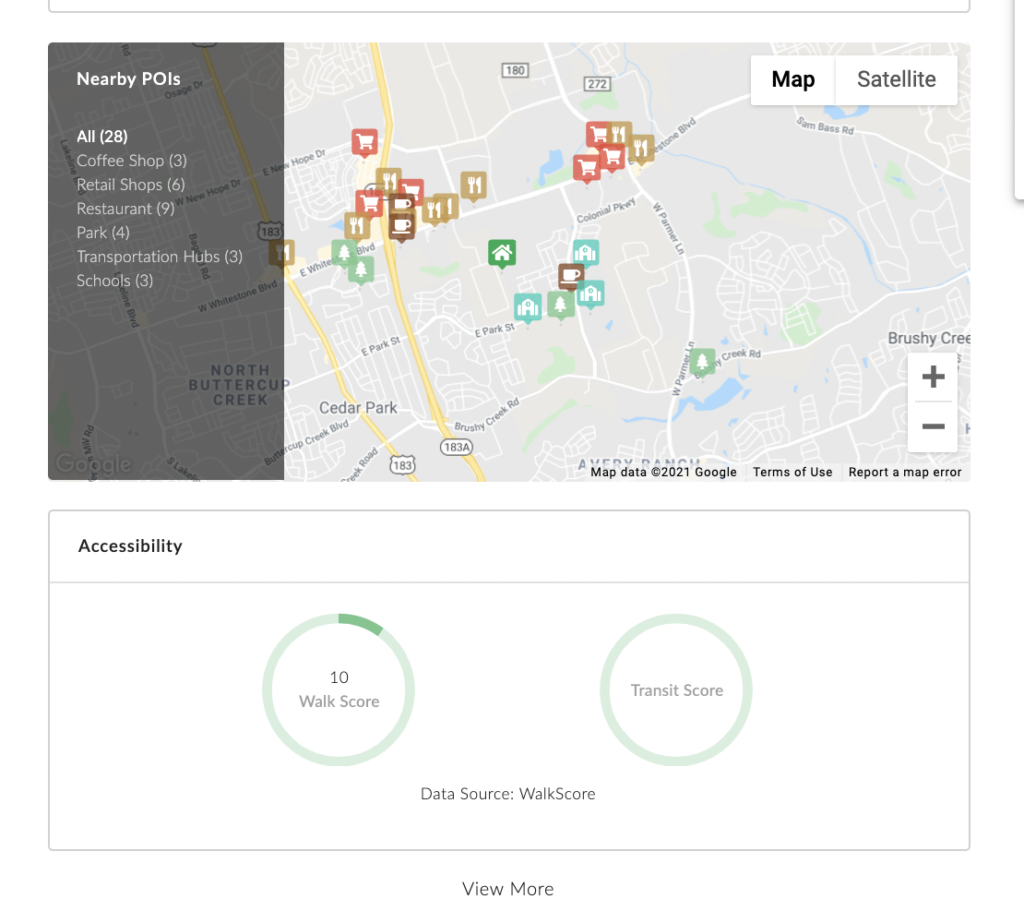

Startups like Ark7 have noticed these obstacles to real estate investing and found ways to capitalize on the high demand of housing. Our team takes care of property management pains for investors, and curates properties in high-demand areas. We also look for homes in close proximity to good schools, parks and amenities. Ark7 offers these properties as fractional shares, allowing investors to diversify their portfolio while leaving the task of property management to professionals.

Sign up to browse properties in hot areas like Austin, Berkeley, and Seattle.