Overview

February marked steady portfolio growth with $79,711.35 in dividends distributed and a 4.50% annualized return rate. Occupancy reached 91.89%, with multiple lease renewals securing higher rental income. Short-term rentals performed well, exceeding 5%+ rental yields, led by Atlanta-C10 (5.72%) and Berkeley-M3 (5.25%).

Trading activity surged, with $160,862 in transactions and a 30% month-over-month increase. Berkeley-M3 led in trading volume, while Chicago-C1 (+13%), Urbana-S11 (+7.12%), and Dallas-S8 (+6%) posted the highest price gains.

Ark7 remains committed to expanding investment opportunities and optimizing returns for investors.

1. Dividend Summary

💰 Total Dividends Distributed: $ 79,711.35

📈 Portfolio Annualized Return Rate: 4.50%

🏆 Top Performing Properties by Dividend Yield:

- Urbana-S11 – 6.99%

- DFW-S17 – 6.60%

- Berkeley-M1 – 6.40%

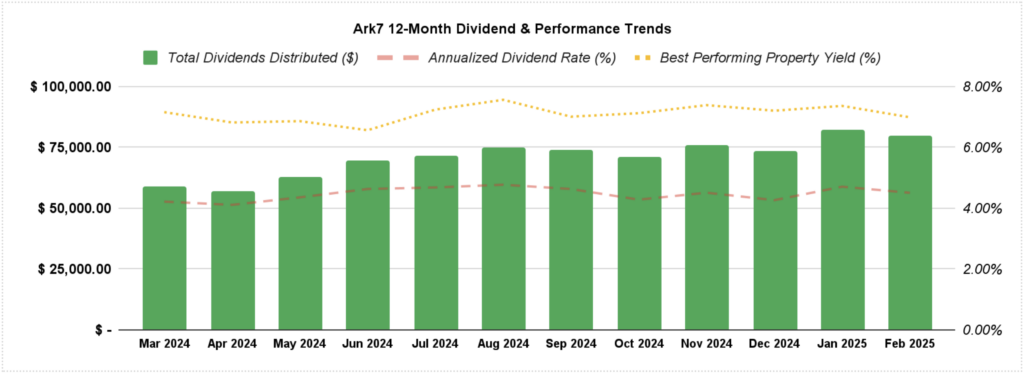

2. Dividend & Performance Trends (Past 12 Months) 📊

3. Portfolio Performance & Rental Updates

Overall Portfolio Snapshot

- Occupancy Rate: 91.89%

- New Leases Signed: 4 (Berkeley, Dallas, Alexandria, Chandler)

- Short-Term Rental Highlights: Atlanta-C10 (5.72%), Berkeley-M3 (5.25%)

Key Rental & Lease Updates

🔹 New Lease Renewals 🏡

- Berkeley-M2 (Apt 1): 12-month lease renewal from 3/1/2025 to 3/1/2026 at $2,400/month (previously $2,200; 9.09% increase). All six units remain occupied.

- Dallas-S7: 12-month lease renewal from 1/31/2025 to 1/31/2026 at $3,400/month (previously $3,300; 3.03% increase post-renovations).

- Alexandria-C2: 2-month lease extension from 3/15/2025 to 5/15/2025 at $1,950/month, catering to mid-term renters.

- Chandler-S5: 12-month lease renewal from 3/1/2025 to 2/28/2026 at $2,290/month.

🔹 Vacancy & Tenant Turnovers

- DFW-S14: Tenant moved out in January 2025; 2-month security deposit secured. Winter damage repairs and roof replacement completed. Working with the insurance company on an ongoing claim.

- DFW-S15: Tenant moved out in January 2025; 2-month security deposit secured. Roof replacement finished; interior remodeling in progress, expected to complete by early March.

- DFW-S16: Tenant moved out in December 2024; 2-month security deposit secured. Repairs completed; listing will be soon.

🔹 Notable Short-Term Rental Performance

The short-term rental segment continues to demonstrate strong performance, exceeding a 5%+ rental yield.

| Property | Dividend |

|---|---|

| Atlanta-C10 | 5.72% |

| Berkeley-M3 | 5.25% |

| Seattle-D1 | 5.10% |

4. Featured Investment Opportunities 🚀

New to passive real estate investing?

Explore Ark7 Opportunities5. Trading Market Growth 📊

- Total Transactions This Month: $ 160,862

- Month-over-Month Growth: 30%

- Properties Available for Trading: 26 (70% of portfolio)

Top 3 Properties by Trading Volume:

The following properties saw the highest trading activity this month, reflecting strong investor interest and market liquidity.

| Property | Trading Volume | Price Change | Trading Volume Growth |

|---|---|---|---|

| Berkeley-M3 | $33,955 | 0% | +126% |

| Tampa-S10 | $27,539 | +2.95% | +180% |

| Alexandria-C2 | $19,420 | -11% | +192% |

Top 3 Properties by Performing (Price Change):

These properties experienced the highest price appreciation, demonstrating strong growth potential and investor confidence.

| Property | Price Change |

|---|---|

| Chicago-C1 | +13% |

| Urbana-S11 | +7.12% |

| Dallas-S8 | +6% |